During an inflationary process borrowers will benefit at the expense of. B low rates of unemployment will cause steadily increasing rates of inflation.

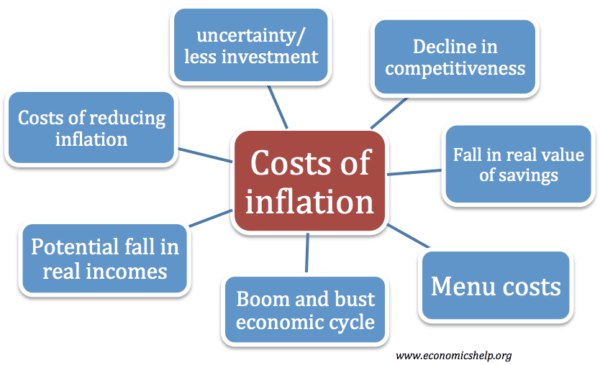

Costs Of Inflation Economics Help

When expected and actual inflation are equal then participants in contracts carry out the transaction as anticipated when the contract was signed.

. BusinessEconomicsQA LibraryAssume that expected inflation is based on the following. If θ 1 we know that A a reduction in the unemployment rate will have no effect on inflation. A leading indicator of inflation based on interest rates.

In 2022 in the wake of the COVID-19 pandemic inflation reached 7 its highest rate in decades. Luckily for all of us inflation has remained quite low since the recession in. The December 2021 CPI inflation rate 68 was the highest recorded in 39 years and producer prices were 98 higher than a year earlier.

Inflation or the rate of change in prices for a basket of goods and services is one of the most anticipated indicators to gauge the overall. The adult population is 201000 and the labor force participation rate is 67. Experts are tested by Chegg as specialists in their subject area.

We review their content and use your feedback to keep the quality high. A significant share of growth is expected from the hardest-hit industries as activity continues to normalize. The Federal Reserve uses monetary policy to achieve its target rate of 2 inflation.

Inflation expectations are simply the rate at which peopleconsumers businesses investorsexpect prices to rise in the future. Using composite leading indicators of consumption to forecast sales and to signal turning points in the stock market. Some analysts have argued that indexed bonds convey important information for the formulation of monetary policy.

We expect growth to reach 38 in 2022 and the level of economic activity to surpass its pre-pandemic peak in Q1. Given a situation of full employment classicists maintained that a change in money supply brings about an equiproportionate change in price level. The number of people employed in a city are 128000.

The level of economic activity is now only 12 below its pre-pandemic level. If a central bank changes its target inflation rate and this change is rapidly perceived by participants in the economy then there are more periods when actual and expected inflation are equal. Relative to the past several decades inflation is rising and survey evidence shows that actual inflation exceeds the expected inflation rate for most people.

Later we add and switch out different variables and different ways of measuring these variables to get other specifications. The main effects of unanticipated inflation are redistributive. What is the expected relationship between the GDP inflation rate and unemployment rate.

Our index is constructed using 21 inflation expectation indicators summarized in table 1. The math is clear that on balance inflation is still a bad thing for our economic health. Expansion and Peak The business cycle runs in four phases.

This paper examines whether the channel was important in the post-WWII US with particular attention to the 2009 Recovery Act period. Specifically the article compares the US. Consumers expected inflation to average 58 over the next 12 months and 35 over the next three years.

Treasury Breakeven Inflation TBI curve a unique measure of market-based inflation expectations with the US. Based on the figures calculate the. This was per a survey conducted by the Federal Reserve Bank of New York.

Monetary policy Higher interest rates reduce demand in the economy leading to lower economic growth and lower inflation. Economic indicators for Australias service sector. This article investigates whether a market measure of expected inflation derived from British indexed gilt prices would be useful in predicting future inflation and real economic activity.

The main policy used is monetary policy changing interest rates. The rate of inflation is an important input in the monetary policy Monetary Policy Monetary policy refers to the steps taken by a countrys central bank to control the money supply for economic stability. 2 We include both short horizon inflation expectations which are typically forecasts for the.

They matter because actual inflation depends in part on what. Canadas level of employment is back to. Each uses a different technique to forecast CPI inflation over the year ahead.

The first phase is the expansion phase. Measures of inflation expectations. We include expectations derived from households firms professional forecasters and financial market participants.

City-average all-items Consumer Price Index for All Urban Consumers CPI-U a measure of actual inflation. However in theory there are a variety of tools to control inflation including. Control of money supply Monetarists argue there is a close link.

1 Expected inflation is generally defined as the expectations of inflation by various economic agents mainly firms and households based on real economic variables in the economy. For investors including real estate investors. According to classical economists or monetarists inflation is caused by an increase in money supply which leads to a rightward shift in negative sloping aggregate demand curve.

What happens to the two other economic indicators when one indicator goes up. One is based on regression analysis and the other is based on the naive specification made popular by Atkeson and Ohanian 2001. Commodity prices as a leading indicator of inflation.

Surprises in inflation rates lead to shifts in income and wealth between different groups of the population. For example policymakers manipulate money circulation for increasing employment GDP price stability by using tools such as interest rates reserves. According to this expected inflation channel government spending drives up expected inflation which in turn reduces the real interest rate and leads to an increase in private consumption.

In January 2022 US.

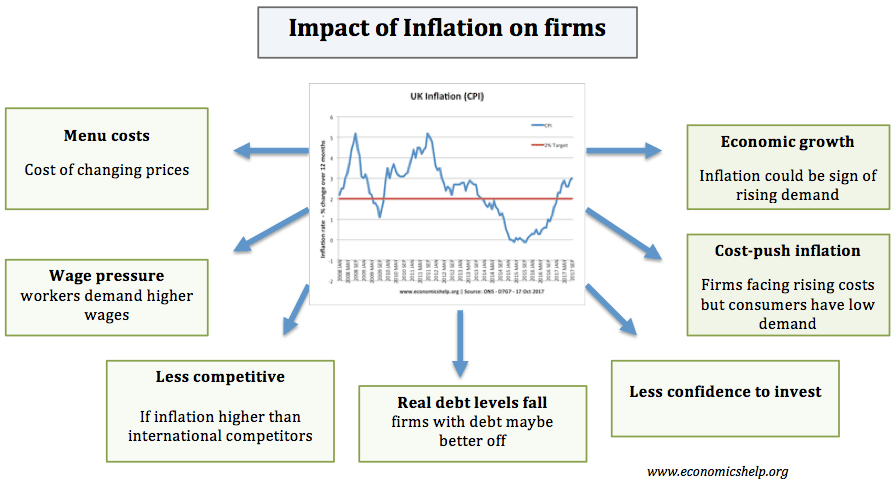

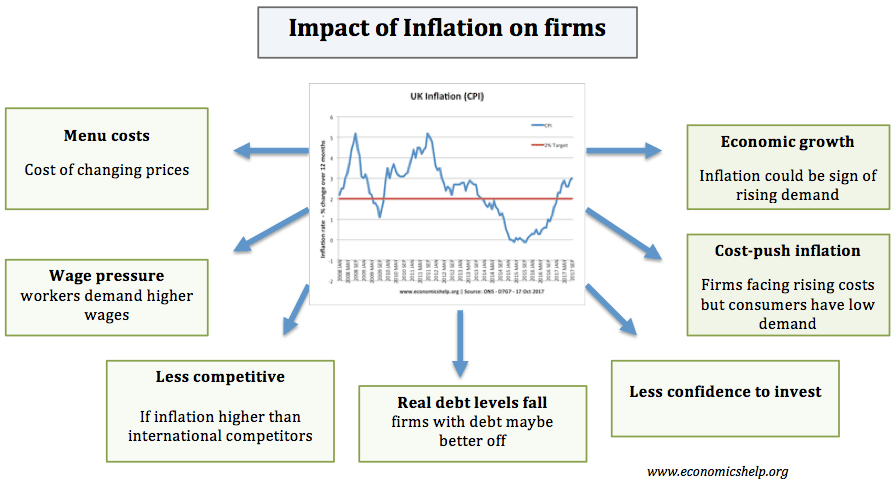

What Are The Effects Of A Rise In The Inflation Rate Economics Help

0 Comments